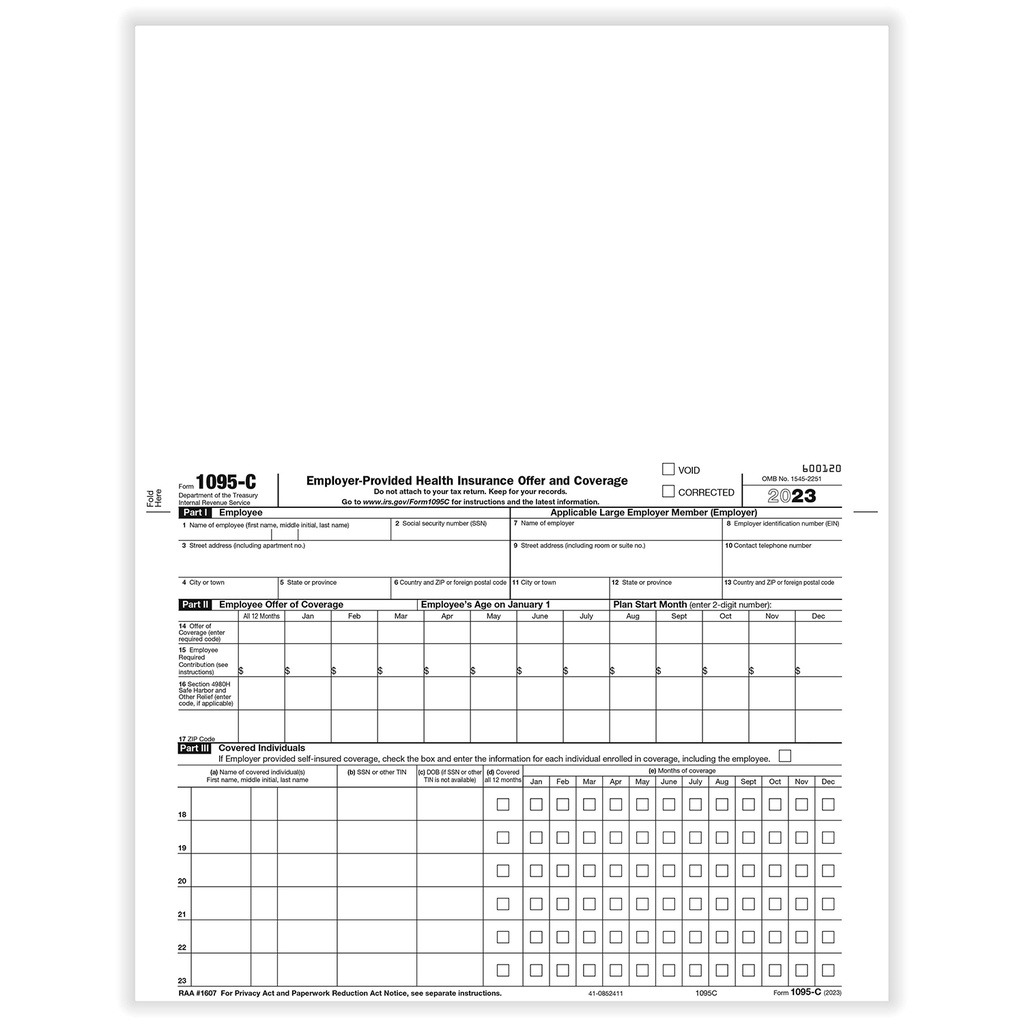

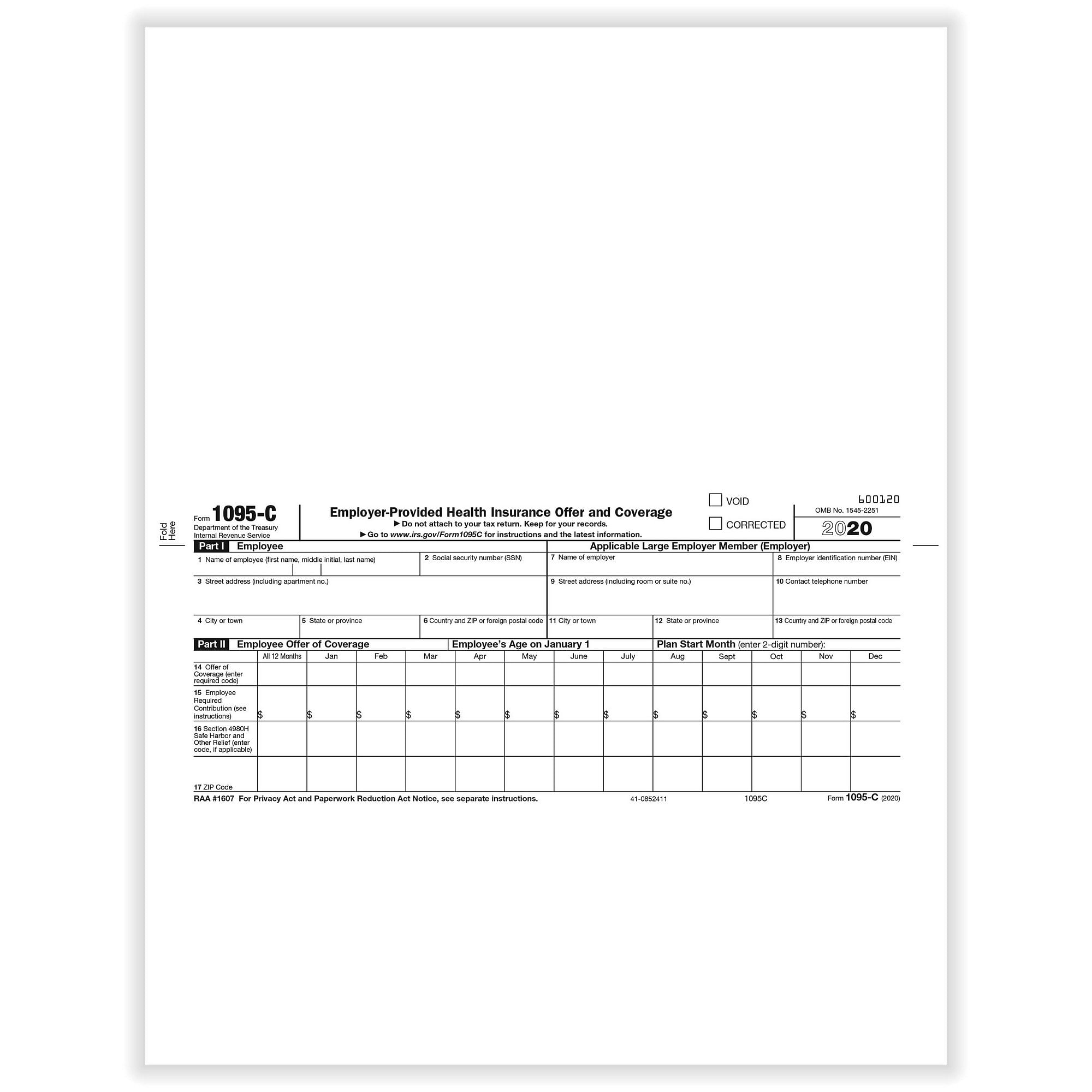

Payroll Services In January, fulltime employees receive a tax form, Form 1095C, that contains detailed information about their health care coverage It is important to keep the form for your records because you will need it to file your tax returnsEmployers are required to furnish Form 1095C only to the employee As the recipient of TIPthis Form 1095C, you should provide a copy to any family members covered under a selfinsured employersponsored plan listed in Part III if they request it for their recordsAll fulltime employees will receive a Form 1095C As defined by the IRS, a "fulltime employee" is one who works, on average, at least 30 hours per week, or 130 hours per month D Is this the only form that I will receive?

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

1095 c form

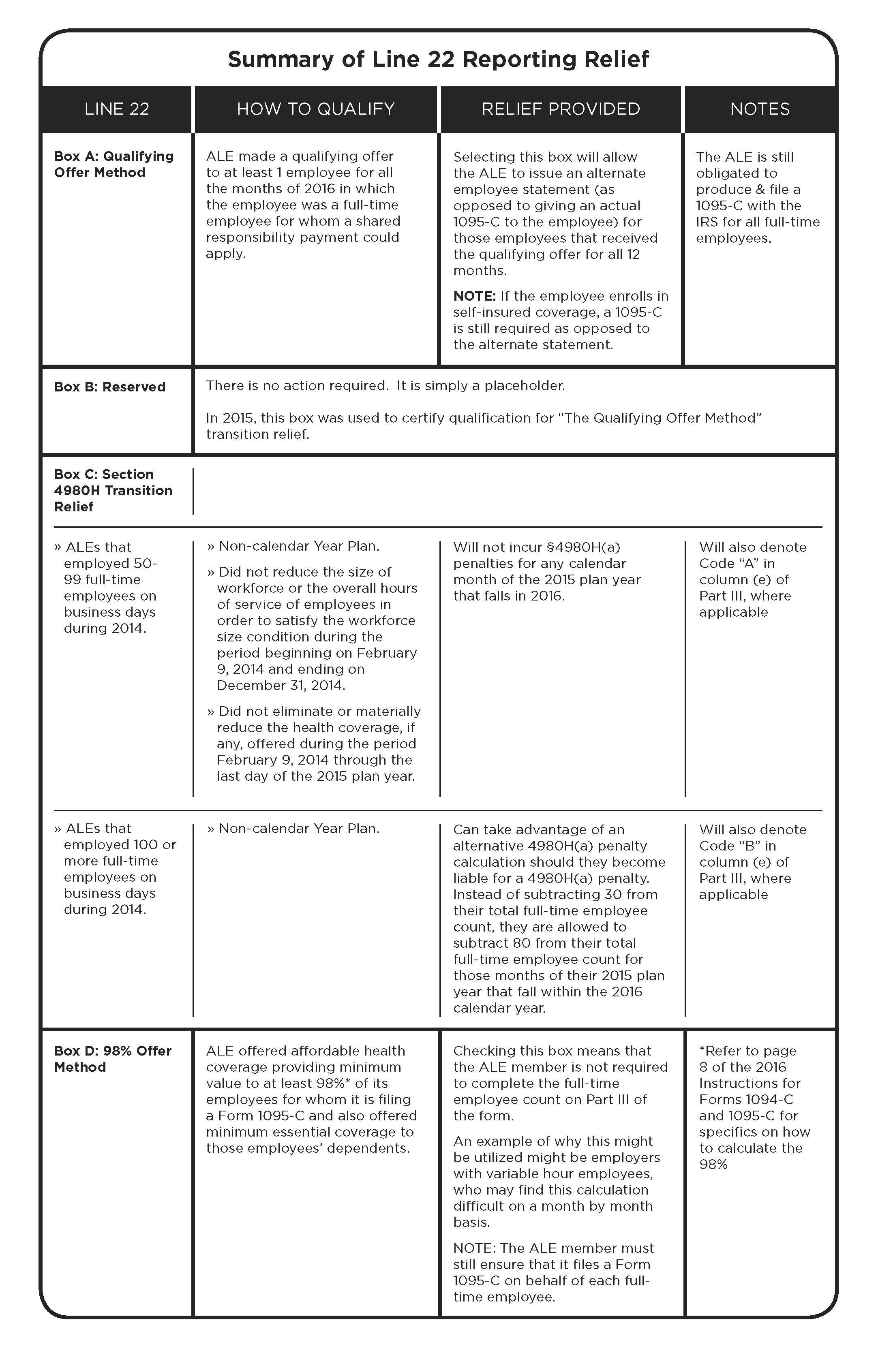

1095 c form-In addition to the 1095C, each employee will also receive(Form 1095C, Line 16) CODE SERIES 2* 2A Employee not employed during the month Enter code 2A if the employee was not employed on any day of the calendar month Do not use code 2A for a month if the individual was an employee of the ALE Member on any day of the calendar

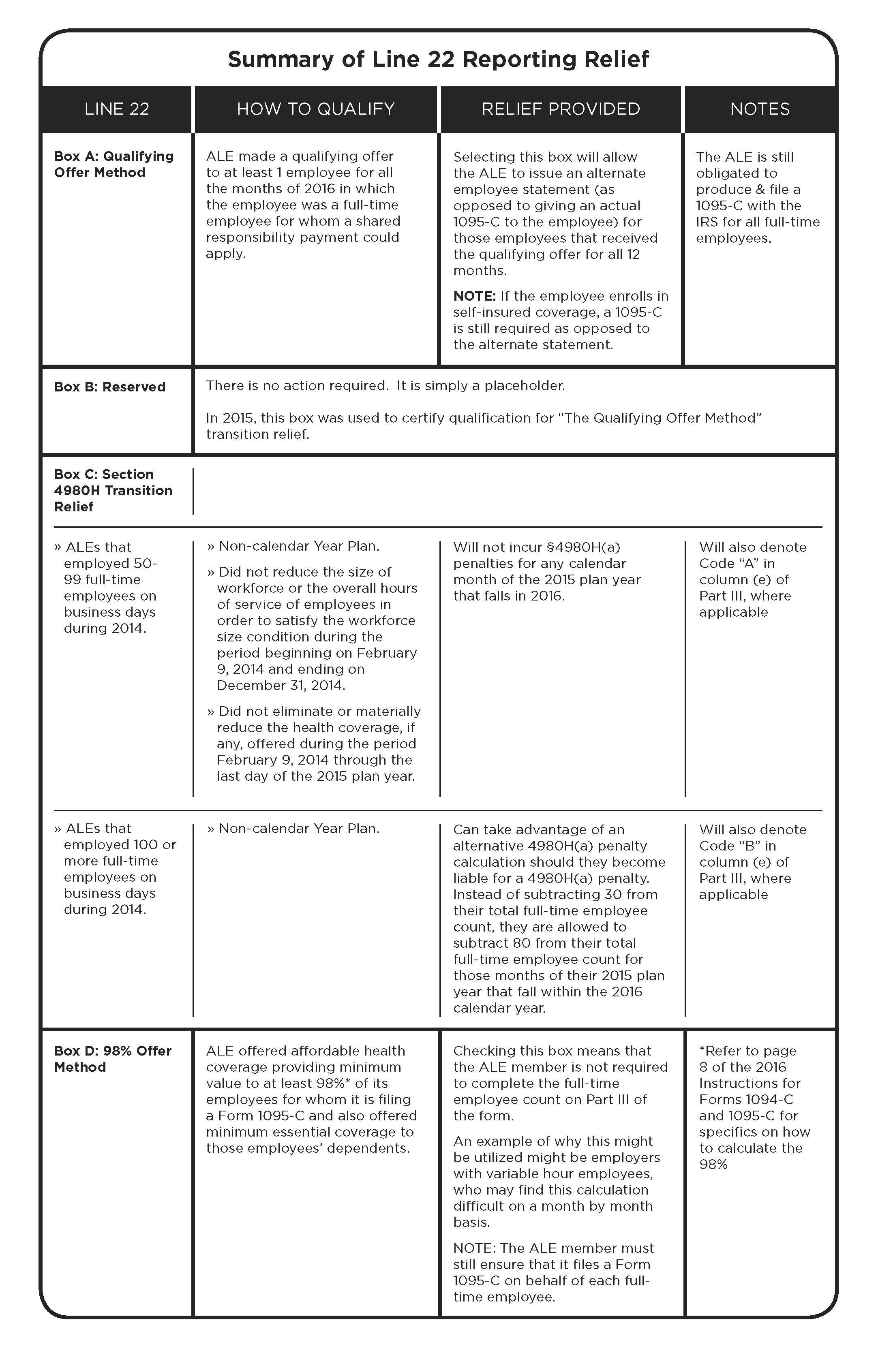

United Benefit Advisors Home News Article

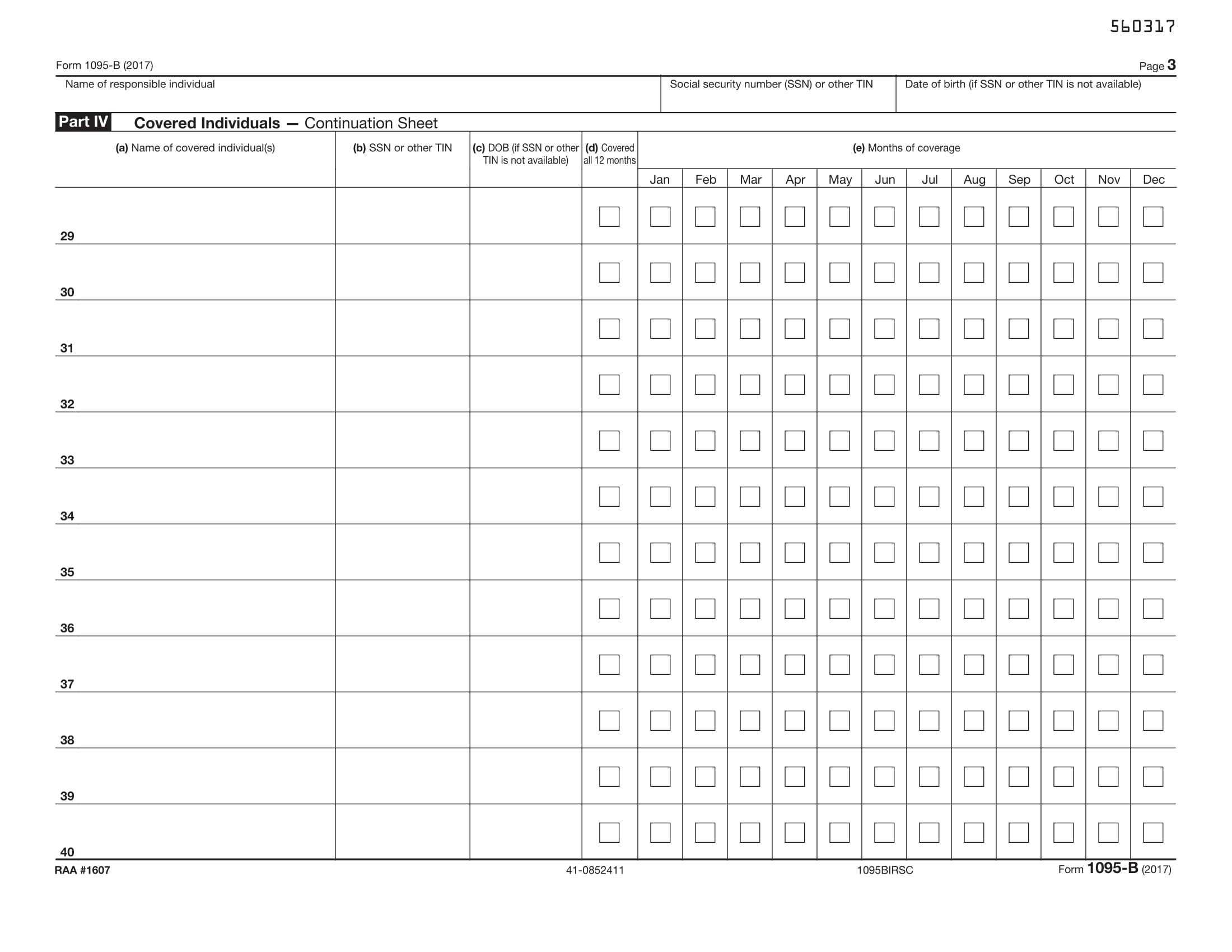

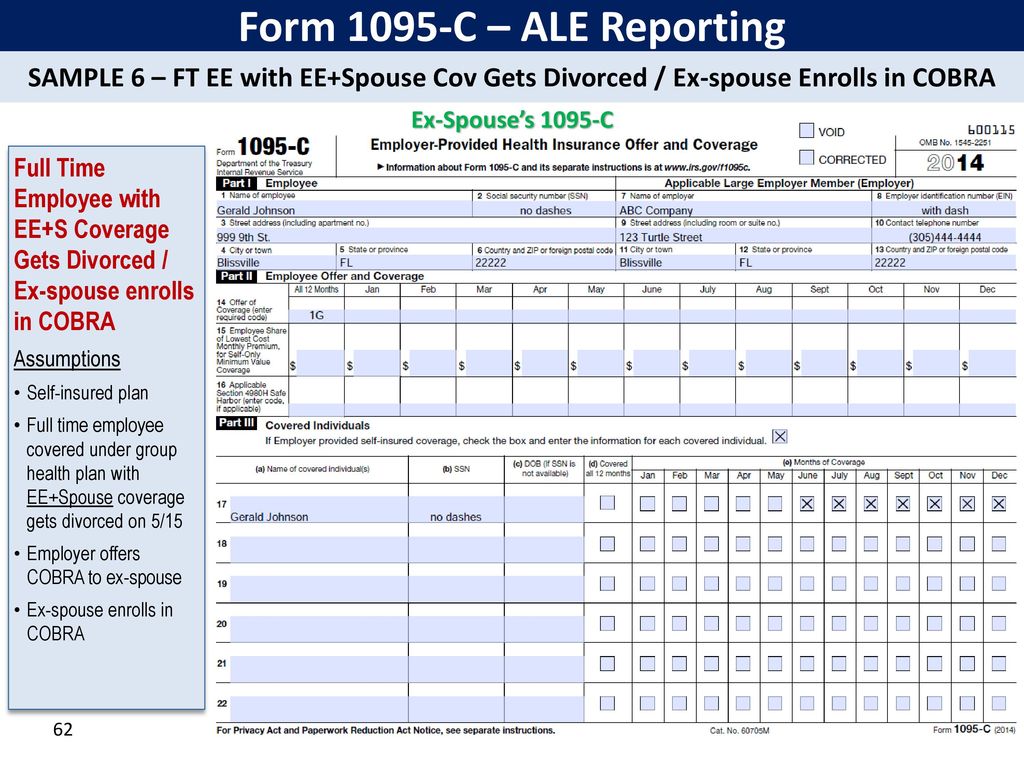

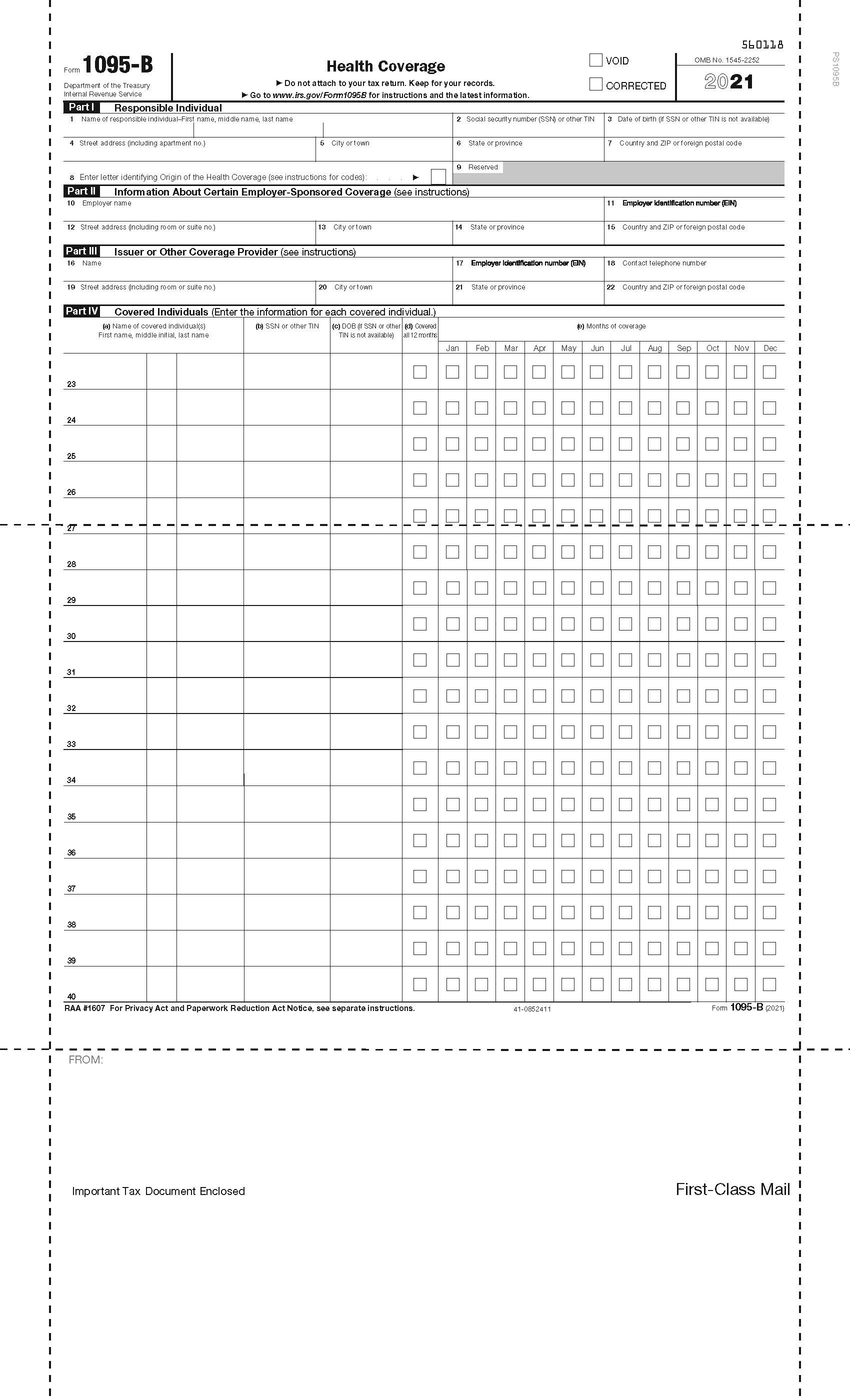

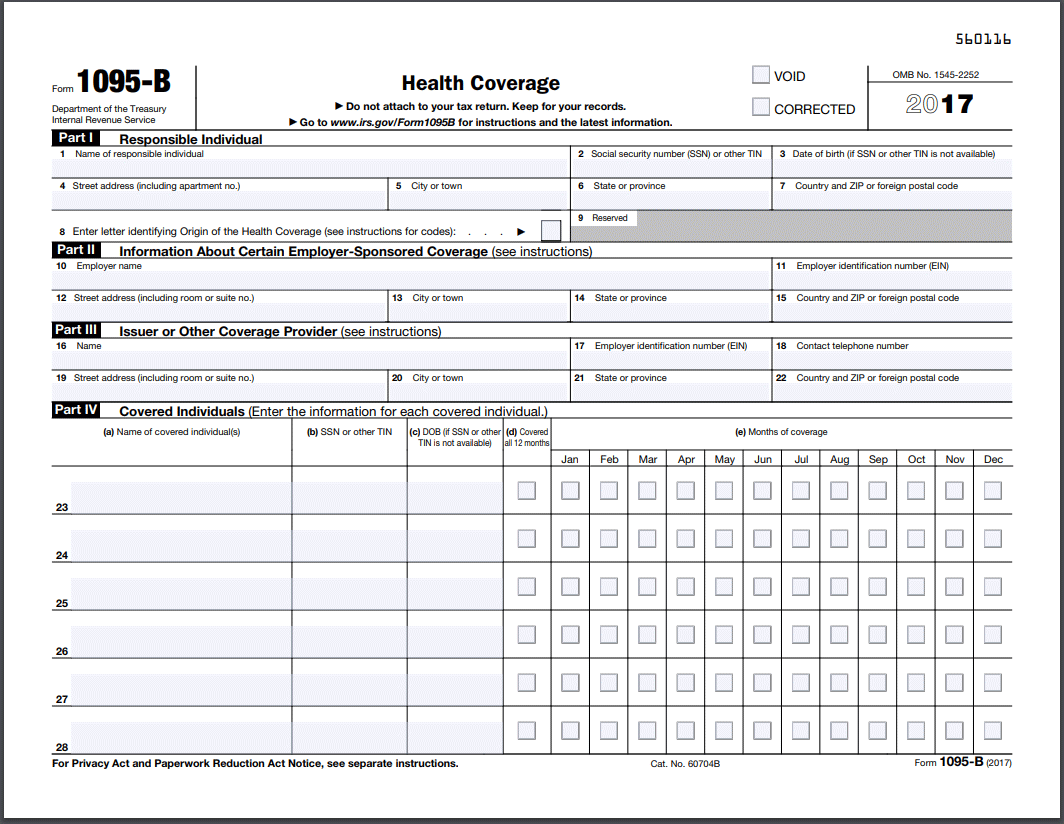

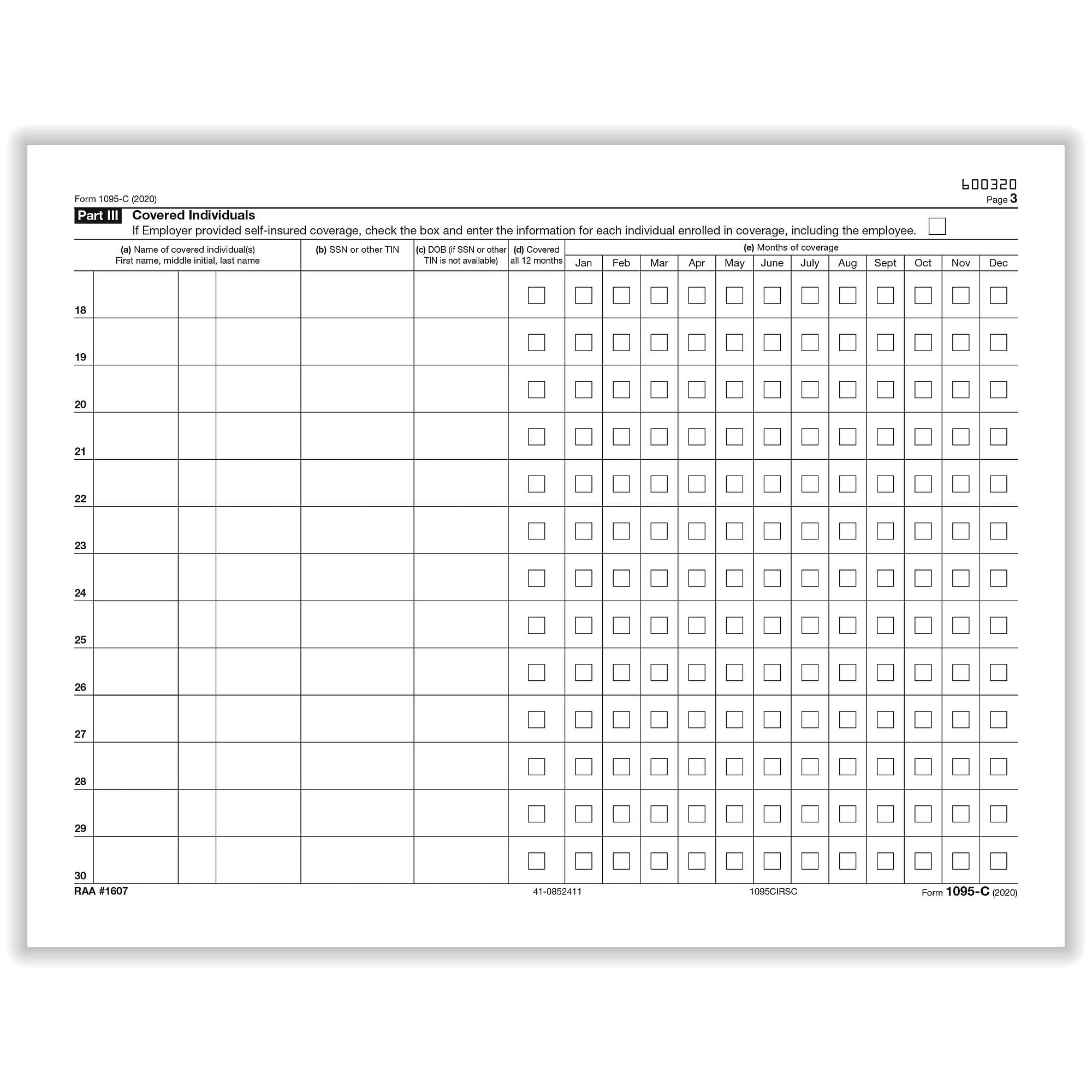

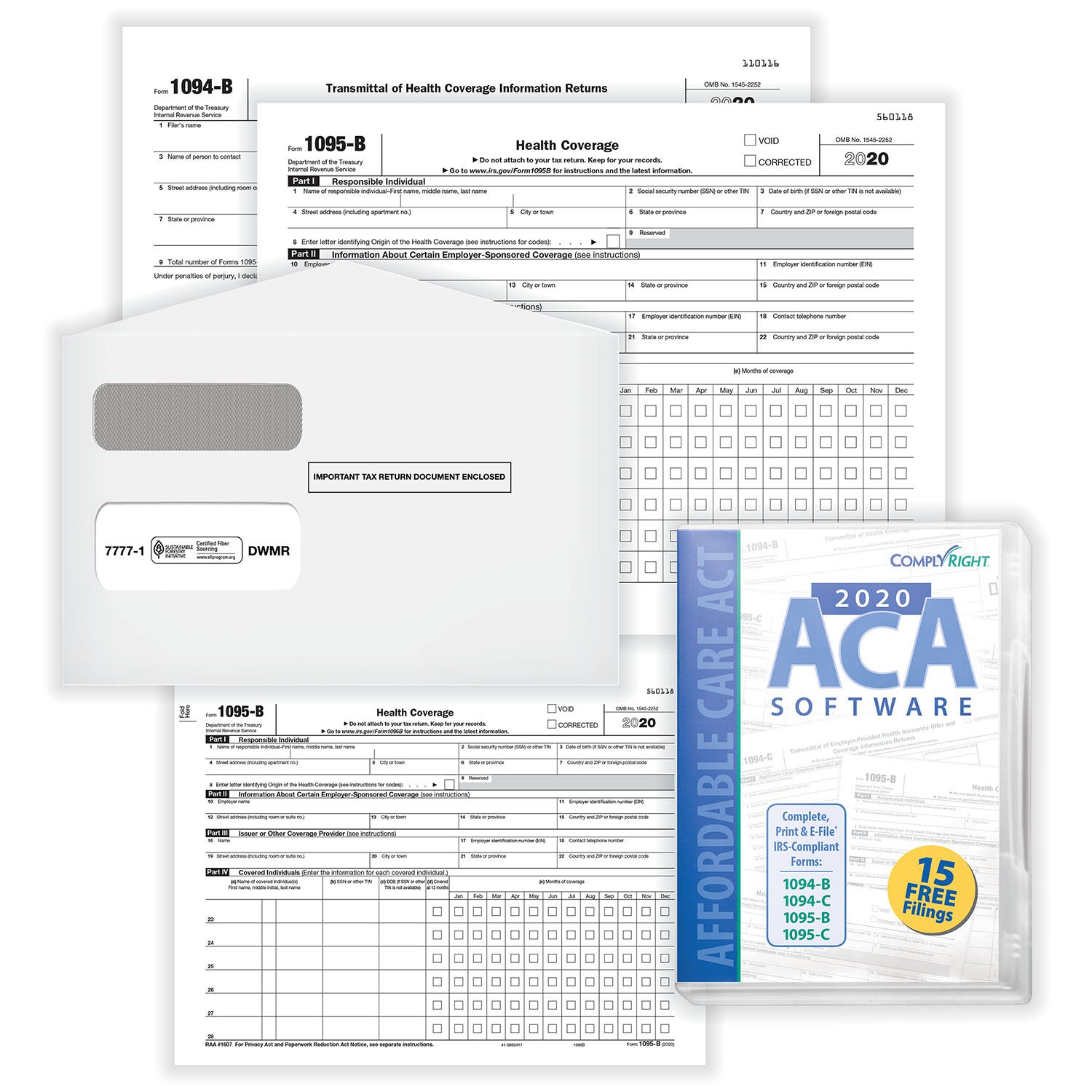

Form 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was covered This form is sent outReference Guide for Part II of Form 1095C Lines 14, 15, and 16 (revised for the final 17 forms) November 17 • Lockton Companies L O CKT O N CO M P ANIES GLOSSARY Children means an employee's biological and adopted children (including children placed with the employee for adoption), from birth, adoption, or placement through the end of the month in which the childEmployers are required to furnish Form 1095C only to the employee As the recipient of TIPthis Form 1095C, you should provide a copy to any family members covered under a selfinsured employersponsored plan listed in Part III if they request it for their records

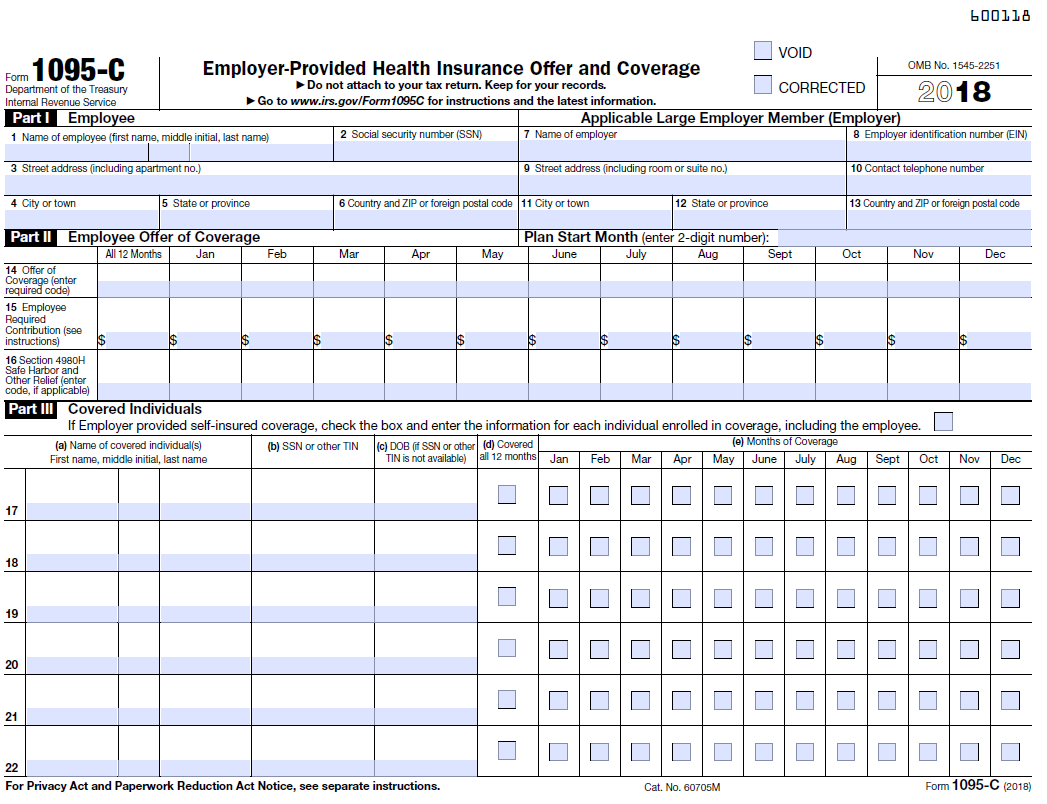

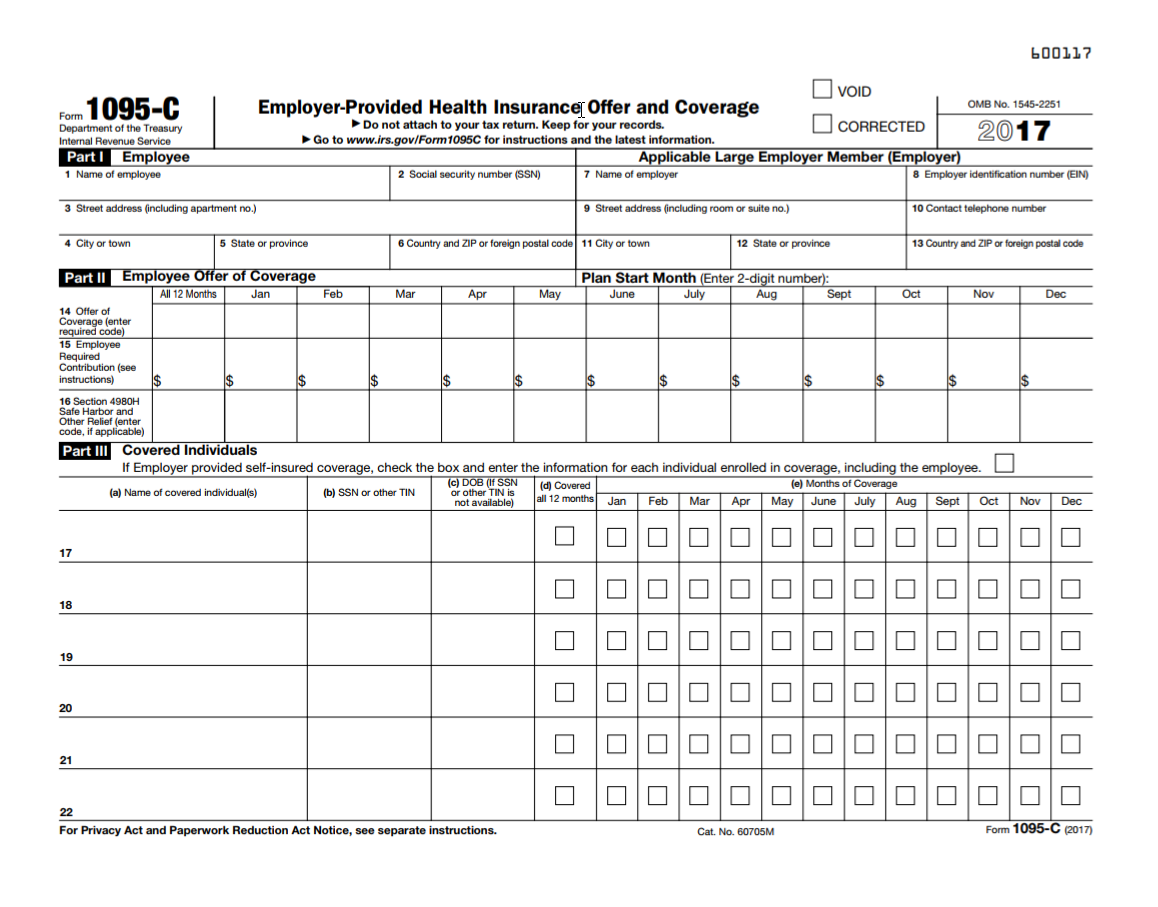

Applicable large employers with 50 or more fulltime or fulltimeequivalent employees use efileACAforms to save on the labor costs of preparing, printing, mailing and manually submitting their 1095C and 1094C forms to the IRS Smaller, selfinsured employers who must fill out the 1095B and 1094B transmittal form use efileACAforms to report the names, addresses and2 Instruction to complete Part II, Employee Offer of Coverage of Form 1095C The IRS has recently made some changes in Form 1095C related to ICHRA plan So, before entering into the lines, employers need to fill the employee's age & plan start month Age If the employee was offered an ICHRA, enter the employee's age onUpdated October On , the IRS extended the due date for the form 1095C reporting requirements This means that the original deadline for issuing form 1095C to employees has moved from to Penn State plans to have the 1095C forms mailed out to individuals by no later than the extended deadline date of

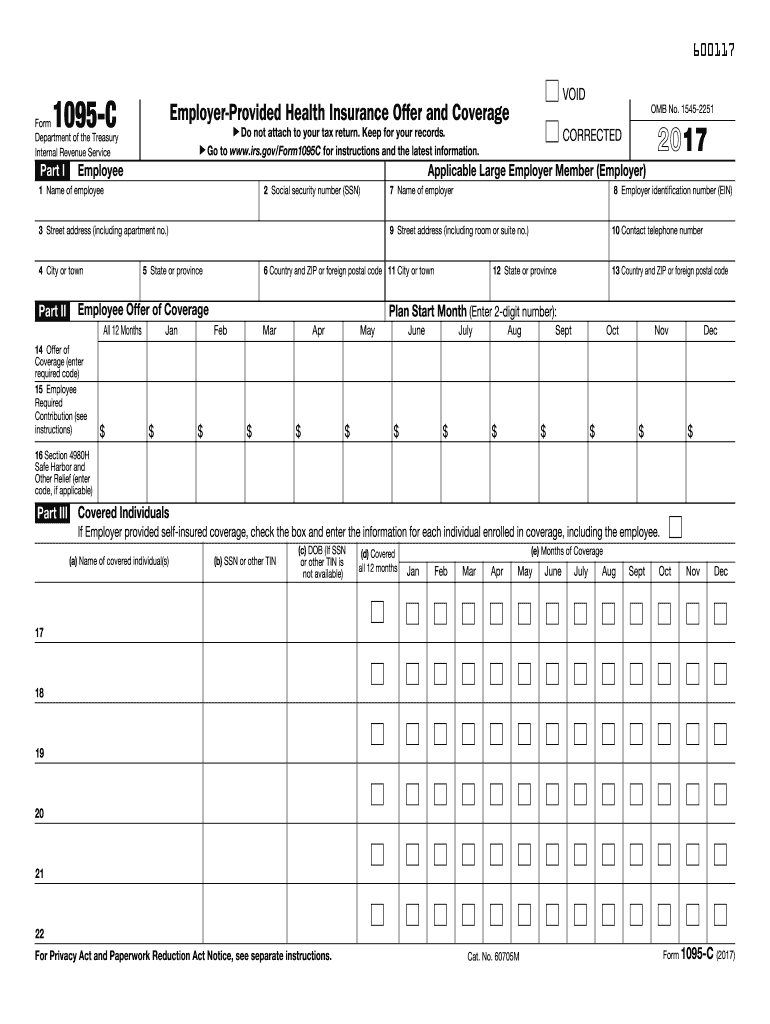

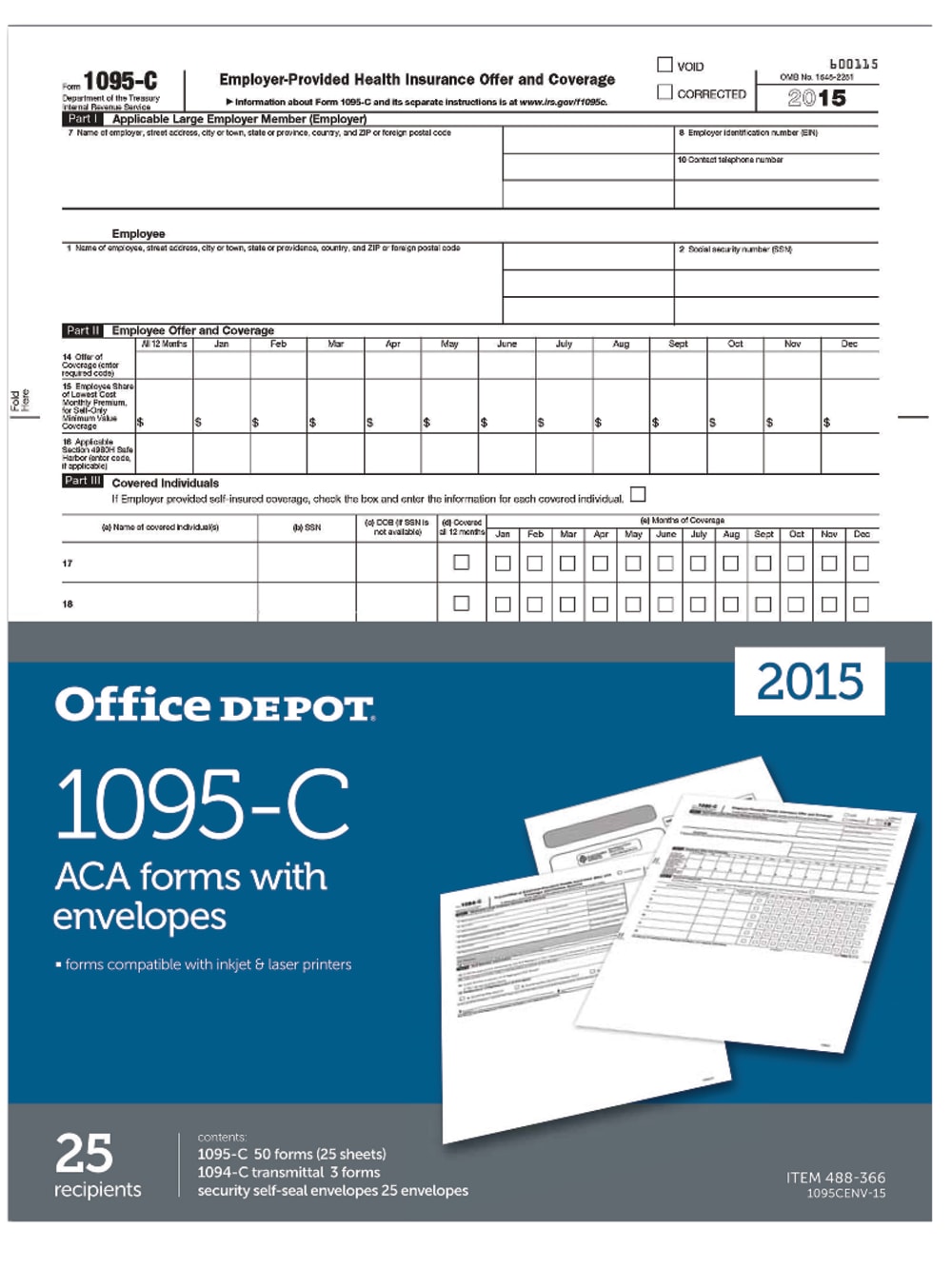

Form 1095C is a tax form that provides you with information about employerprovided health insurance IRS Form 1095C is a statement provided by an Applicable Large Employer (ALE) to each of its employees who were eligible for coverage in the previous year The form helps the IRS enforce the ACA employer mandate by monitoring the type and cost of coverage offered to employees, and the number of employees who were offered this coverage Form 1095CForm 1095C (EmployerProvided Health Insurance Offer and Coverage) is given to any employee of an applicable large employer (those with 50 or more fulltimeequivalent employees who worked full time for 1 or more months of the year) Employers who selfinsure must also report on which employees and dependents are covered

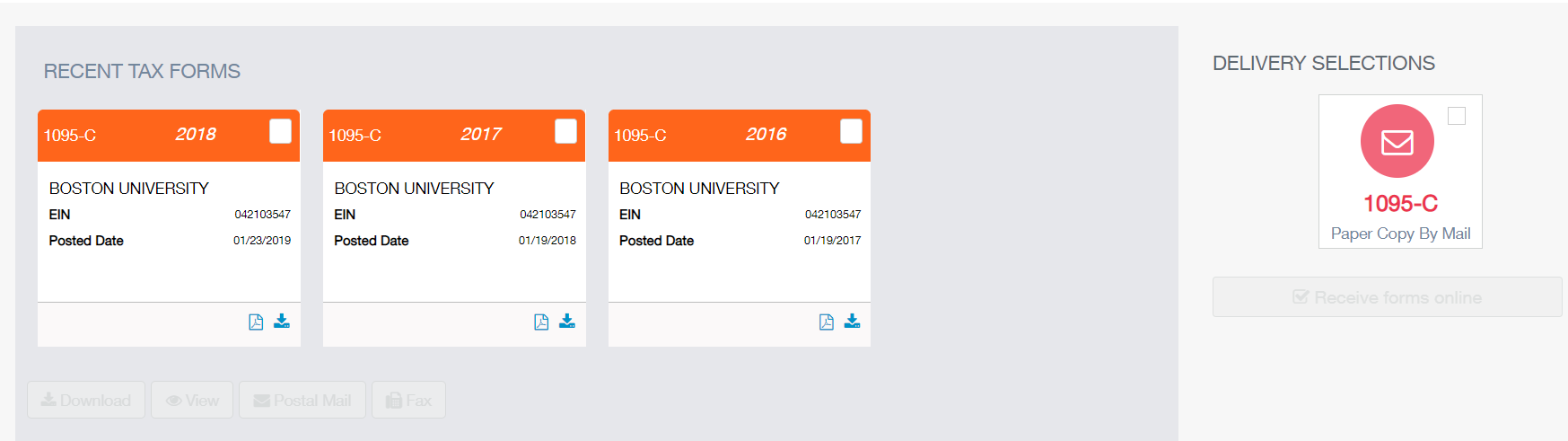

Your 1095 C Tax Form For Human Resources

Http Www Aetna Com About Aetna Insurance Document Library Affordable Care Act Reporting Tax Forms Pdf

Form 1095C This tax form is normally sent to employees by their employer prior to January 31 each year IRS Notice 76 (page 6, paragraph A) extends the deadline to provide the form by Form 1095C for federal civilian employees paid by DFAS and military members will be available on myPay NLT January 31 Forms will be mailed1095C forms are prepared for employees that were fulltime as defined by the ACA or were under an offer of coverage during 16 If you think you should have received a form from your employer, please call ACA Inquiry Services at (855) 51095C Form Information This new 1095C Form, related to the Affordable Care Act (ACA), is a certificate of EmployerProvided Health Insurance Offer and Coverage Beginning with tax year 15, this form is required by all large employers to report offers of health coverage and enrollment in health coverage

2

Irs Form 1095 A 1095 B And 1095 C Blank Lies On Empty Calendar Page With Pen And Dollar Bills Tax Period Concept Copy Space For Text Stock Photo Alamy

Form 1095A Health Insurance Marketplace Statement Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement Form 1095B Health Coverage Form 1095CForm 1095C shows if you had health insurance through your employer Since you don't actually need this form to file your taxes, you don't have to wait to receive it if you already know what months you did or didn't have health insurance When you do get the form, keep it with your other tax information in case you should need it in theForm 1095C is a reference document that is not completed by the taxpayer It is not filed with a tax return Instead, it should be kept with the taxpayer's records Part I of the form provides

U S Affordable Care Act Aca Information Reporting 16 Sap Blogs

Your 1095 C Obligations Explained

What is the deadline to file ACA Form 1094 and 1095C An ALE should furnish an ACA Form 1095C to each of its fulltime employees by , for the calendar year An ALE should file ACA Forms 1094C and 1095C by , if you choose to file electronically, and the Form should file by , if filing on paperForm 1095C – Employer Provided Health Insurance Every employee of an employer that has 50 or more fulltime employees who are eligible for insurance coverage should receive Form 1095C, a statement of the Employer Provided Health Coverage How do I complete line 15 on the 1095C form?

Aca Forms

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

The new Form 1095C requires a large amount of information that employers must track throughout the calendar year Forms must be sent to employees annually by January 31 Companies with more than 250 employees are required to electronically file copies with the IRS and submit a transmittal Form 1094C by March 31 1095C I think I'm getting fined I have Covered California from July to Dec (1095A Form), my previous employer sent me 1095C for Jan to May but there is no where I can enter on Turbo Tax I heard if you don't have health insurance for 3 months you are finedLine 15 on the 1095C is for the employee required contribution Line 15 is only required if you entered code 1B, 1C, 1D, 1E, 1J, 1K, 1L, 1M, 1N, 1O, 1P, 1Q, 1T, 1U on line 14 To complete line 15, enter the dollar value of the employee required contribution, which is generally the employee share of

Form 1095 And The Aca Office Of Faculty Staff Benefits Georgetown University

Sample 1095 C Forms Aca Track Support

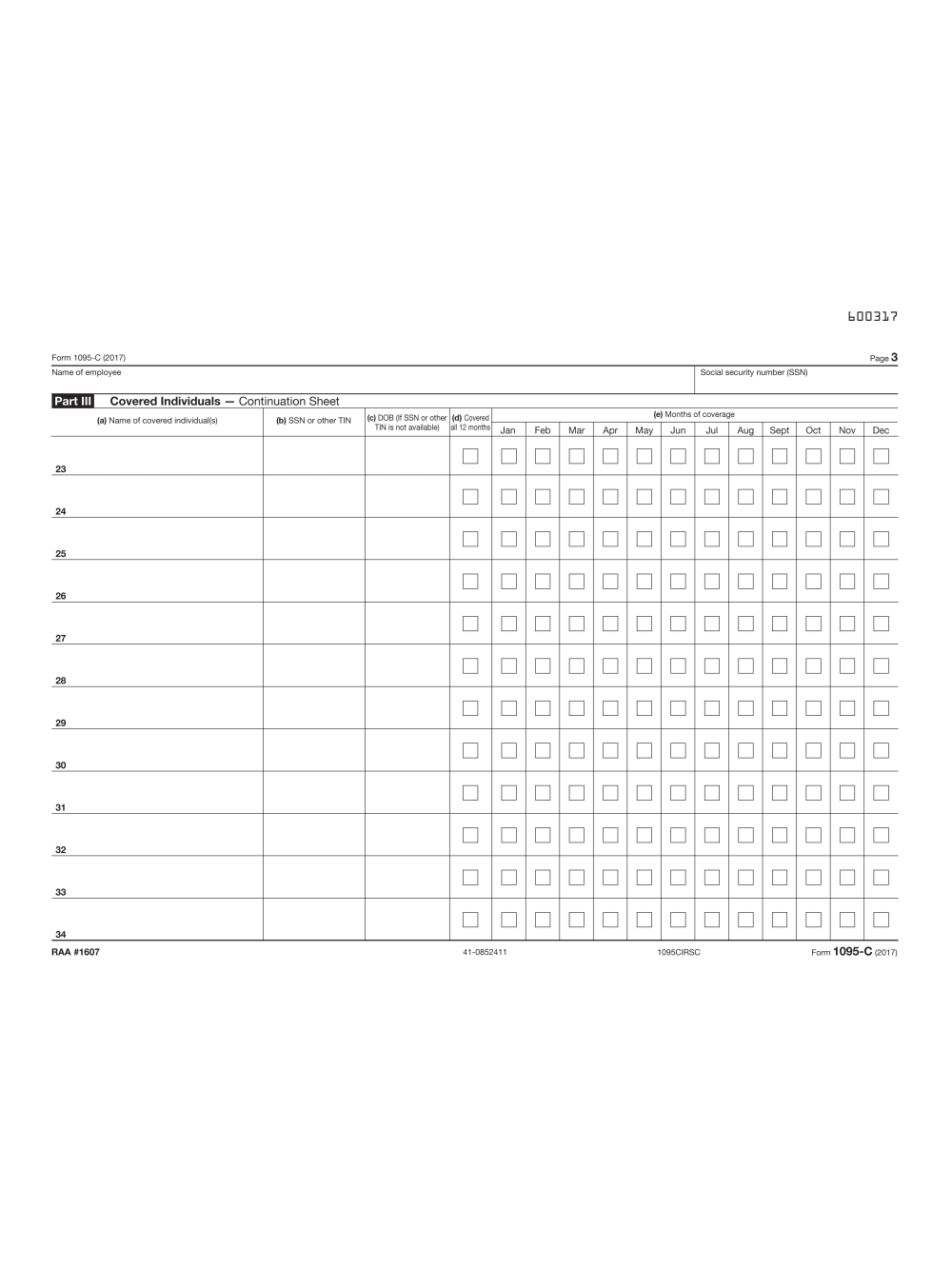

Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C is issued by large employers required to offer coverage to employees This form reports both Offer of coverage to an employee Coverage of the employee if the employer is selfinsured and the employee enrolls in coverage However, just like with the 1095B, mostForm 1095C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a fulltime employee for one or more months of the calendar ALE members must report that information for all twelve months of the calendar year for each employeeIf you worked at more than one agency, municipality or company, you may receive a Form 1095C from each employer For example, if you changed jobs during the year and were enrolled in coverage with both employers, you should receive a 1095C from each employer Please note If you work for more than one job at the Commonwealth of MA (including

Die Buchstaben 1095 A 1095 B Und 1095 C Liegen Foto Vorratig Crushpixel

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

About the Form 1095C The Office of the Comptroller will mail paper Forms 1095C (Affordable Care Act) by the end of February Forms 1095B and 1095C should be kept with tax records Do not submit them to the IRS or Massachusetts Department of Revenue To view your Form 1095C in HR/CMS SelfService For anyone who previously chose suppression of paper forms, the FormInst 1094C and 1095C Instructions for Forms 1094C and 1095C 16 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 15 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095CEmployers are required to furnish Form 1095C only to the employee As the recipient of TIPthis Form 1095C, you should provide a copy to any family members covered under a selfinsured employersponsored plan listed in Part III if they request it for their records

Control Tables And Sample Forms

Irs Issuing 1094 C 1095 C Penalties Essential Staffcare

Form 1095B is used to verify on tax returns that an individual and his or her dependents have at least minimum essential coverage (MEC) Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C is used by larger companies with 50 or more fulltime or fulltime equivalent employees When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14 Form 1095C contains a series of codes that indicate employee health insurance coverage For traditional health coverage, applicable codes include 1A through 1H If using a benefits administration software that automates the Form 1095C process, the software should populate the codes for the months they were enrolled in coverage

1095 C 18 Public Documents 1099 Pro Wiki

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

About the Form 1095C The Office of the Comptroller will mail paper Forms 1095C (Affordable Care Act) by the end of February Forms 1095B and 1095C should be kept with tax records Do not submit them to the IRS or Massachusetts Department of Revenue To view your Form 1095C in HR/CMS SelfServiceThis relief is described under Offer of Health Coverage in the Definitions section of IRS instructions for Forms 1094C and 1095C 2F Section 4980H affordability Form W2 safe harbor Enter code 2F if the employer used the section 4980H Form W2 safe harbor to determine affordability for purposes of section 4980H(b) for this employee for the Form 1095B, Health Coverage, should come in the mail if you purchased or received insurance outside of an exchange Form 1095C, EmployerProvided Health Insurance Offer and Coverage, is required by companies who meet the qualifications to be considered Applicable Large Employers This includes employers with 50 or more fulltime employees in

Aca Forms

Forms 1095 B And 1095 C What You Need To Know

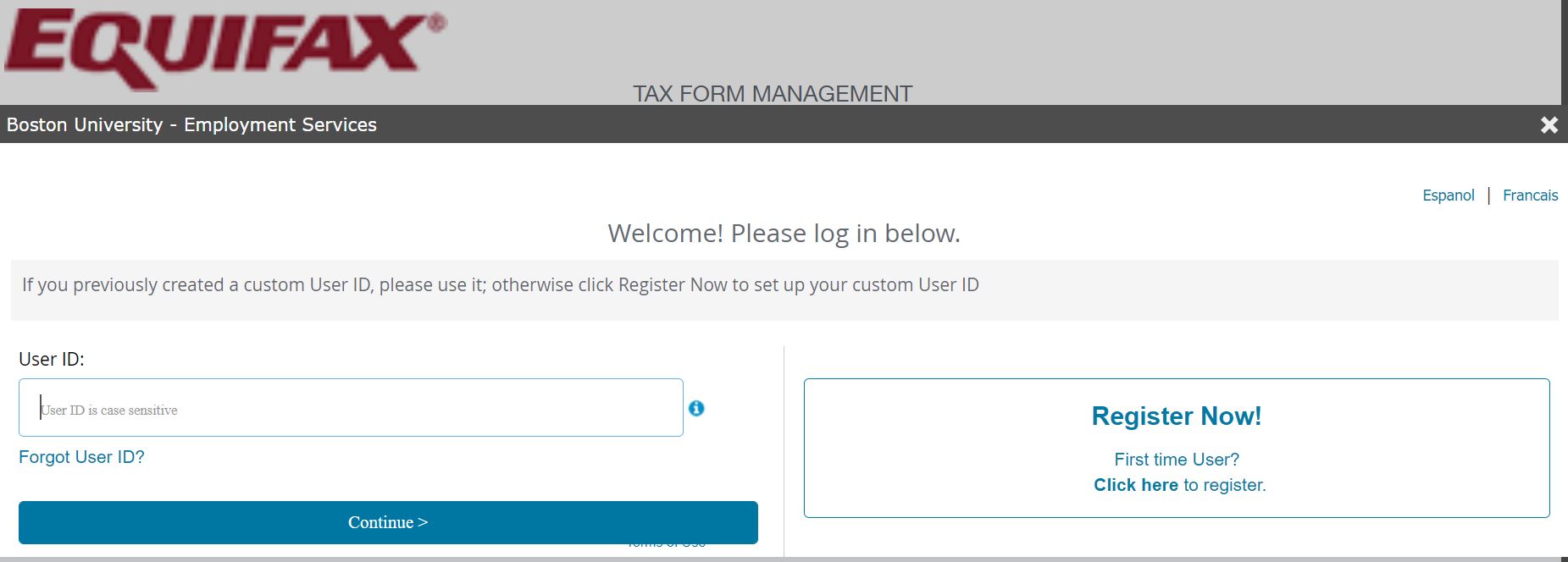

IRS Form 1095 C Information Form 1095C is an annual statement that employers must provide fulltime employees and those covered by its health insurance plan You can get yours Mailed to your home Please be sure your current mailing address is in Self Service It will be mailed to you by

What Does A 1095 C Delay Mean For 1040 Filings Integrity Data

Clearing Aca Confusion Which Employees Get Irs Form 1095 C

Amazon Com Form 1095 C Health Coverage And Envelopes With Aca Software Includes 6 1094 B Transmittal Forms Pack For 100 Employees Office Products

Www Cps Edu Globalassets Cps Pages Staff Former Employees Payroll Form1095 C Faq Pdf

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

W 2 Laser Federal Irs Copy A

Irs Form 1095 C Uva Hr

United Benefit Advisors Home News Article

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Www Miamidade Gov Humanresources Library Faq Form 1095c Pdf

1095 C Irs Employer Provided Health Insurance Form Pack Of 100 Amazon In Office Products

1095 C Form 21 Irs Forms

Updated Hr S Guide To Filing And Distributing 1095 Cs Bernieportal

Employeeservices Sccgov Org Sites G Files Exjcpb531 Files How to read your 1095 C Pdf

Form 1095 A 1095 B 1095 C And Instructions

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

The New 1095 C Codes For Explained

1

Affordable Care Act Aca Forms Mailed News Illinois State

Logo Your Compliance Edge Toggle Navigation Employee Benefits Benefits Notices Calendar Benefits Notices By Company Size Cafeteria Plans Cobra Dental Insurance Dol Audits Educational Assistance Employee Assistance Programs Eaps Erisa

1095 C Form For Android Apk Download

2

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

2

Www Utdallas Edu Hr Download Irs Form 1095 C Faq Pdf

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Irs Extends Deadline For Aca Forms To Be Sent To Employees Stratus Hr

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Sonomacounty Ca Gov Workarea Downloadasset Aspx Id

Your 1095 C Obligations Explained

3

Understanding Form 1095 C And What To Do About Errors The Aca Times

1095 C Irs Employer Provided Health Insurance Offer And Coverage Continuation Form Landscape Version 25 Sheets Pack

Form 1095 C Forms Human Resources Vanderbilt University

Www Brown Edu About Administration Human Resources Sites Human Resources Files Form 1095 C delivery information Pdf

Updated Affordable Care Act Form 1095 C Methodist Health System

1095 C 15 Pdf

2

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer

Www Khisolutionsinc Com Docs Khi Employee 1095 Faqs Paychex Pdf

Http Www Fleming Kyschools Us Userfiles 4 My files Finance 1095c letter to employees Pdf Id

Irs Form 1095 C Mymontebenefits Com

Instructions For Forms 1095 C Taxbandits Youtube

1

Updates To Form 1095 C For Filing In 21 Youtube

Hr Updates Theu

Www Talgov Com Uploads Public Documents Retirement 1095 Faq Pdf

17 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

1095 C Faqs Mass Gov

Pack Of 150 Forms Form 1095 C Health Coverage And Envelopes Includes 3 1094 B Transmittal Forms Tax Forms Human Resources Forms Ekoios Vn

Www Umassmed Edu Globalassets Human Resources Documents Benefits Final 1095 C Faq 12 16 15 Pdf

Www Ddouglas K12 Or Us Wp Content Uploads 17 11 From 1095 Faq 17 Pdf

Sample 1095 C Forms Aca Track Support

Www Basiconline Com Wp Content Uploads 15 12 1095 Employee Communication 15 Pdf

Www Toutlesd Org For Staff Affordable Care Act Faqs

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1

Www Umass Edu Humres Sites Default Files 1095 C faq 0117 0 Pdf

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

Form 1095 C H R Block

Www Irs Gov Pub Irs Prior F1095c 15 Pdf

Tax Form 1095 C Employer Provided Health Insurance 1095c Form Center

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Oklahoma Gov Content Dam Ok En Omes Documents Faq Irs1095creporting Pdf

Irs Form 1095 A 1095 B And 1095 C Blank Lies On Empty Calendar Page Stock Image Image Of Budget Currency

Your 1095 C Tax Form For Human Resources

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

1095 C Employer Provided Health Insurance Offer And Coverage Form 250 Sheets Pack

Amazon Ehr Com Ess Client Documents Benefitsummaries 1095 C faqs updated 1 16 17 Pdf

Montreal Canada March 5 17 1095 C Usa Federal Tax Form Stock Photo Alamy

1095 C Template Fill Online Printable Fillable Blank Pdffiller

Www1 Nyc Gov Assets Olr Downloads Pdf Health 1095 C Form Pdf

Irs Formular 1095 C Arbeitgeberorientierte Krankenversicherungsangebote Und Deckungssteuer Liegen Mit Fullfederhalter Und Viele H Stockbild Bild Von Intern Berechnung

Die Formulare 1095 A 1095 B Und 1095 C Liegen Foto Vorratig Crushpixel

S A M P L E 1 0 9 5 C F O R M S C O M P L E T E D Zonealarm Results

Office Depot

Www Cgesd Org Cms Lib Az Centricity Domain 42 Memo to employees re 1095c forms and faqs Pdf

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Erp Software Blog

Office Depot

Www Fscj Edu Docs Default Source Hr Communications Irs Form 1095 C Faqs Pdf Sfvrsn 2

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

Pack Of 150 Forms Form 1095 C Health Coverage And Envelopes Includes 3 1094 B Transmittal Forms Tax Forms Human Resources Forms Ekoios Vn

Standard Register Laser Tax Forms 1095c Irs Copy 50 Sheets Per Pack Sr Direct

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Affordable Care Act Form 1095 B Form And Software 50 Pk Hrdirect

1095 C Printing Microsoft Dynamics Gp Forum Community Forum

No comments:

Post a Comment