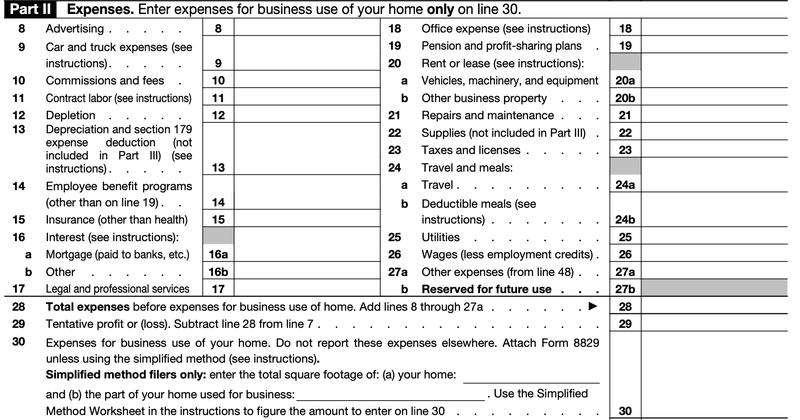

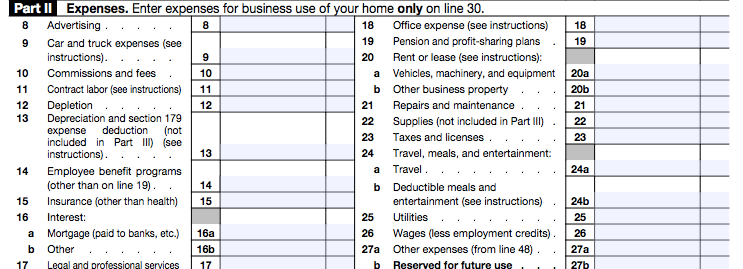

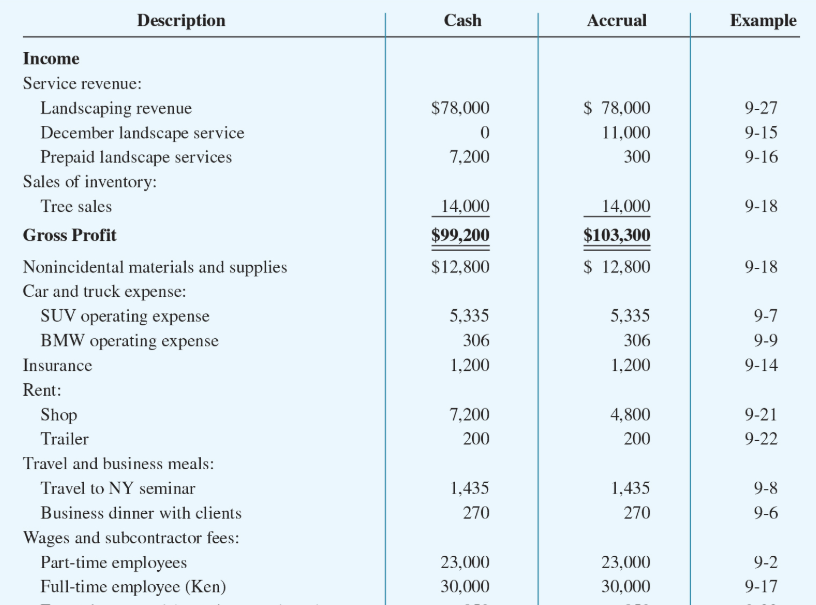

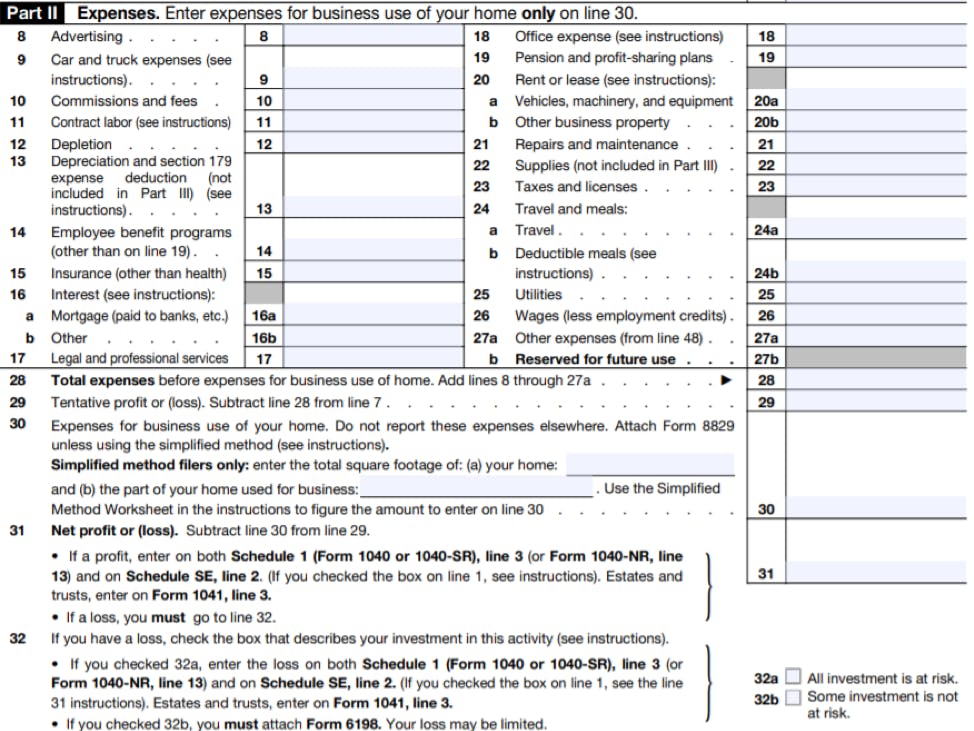

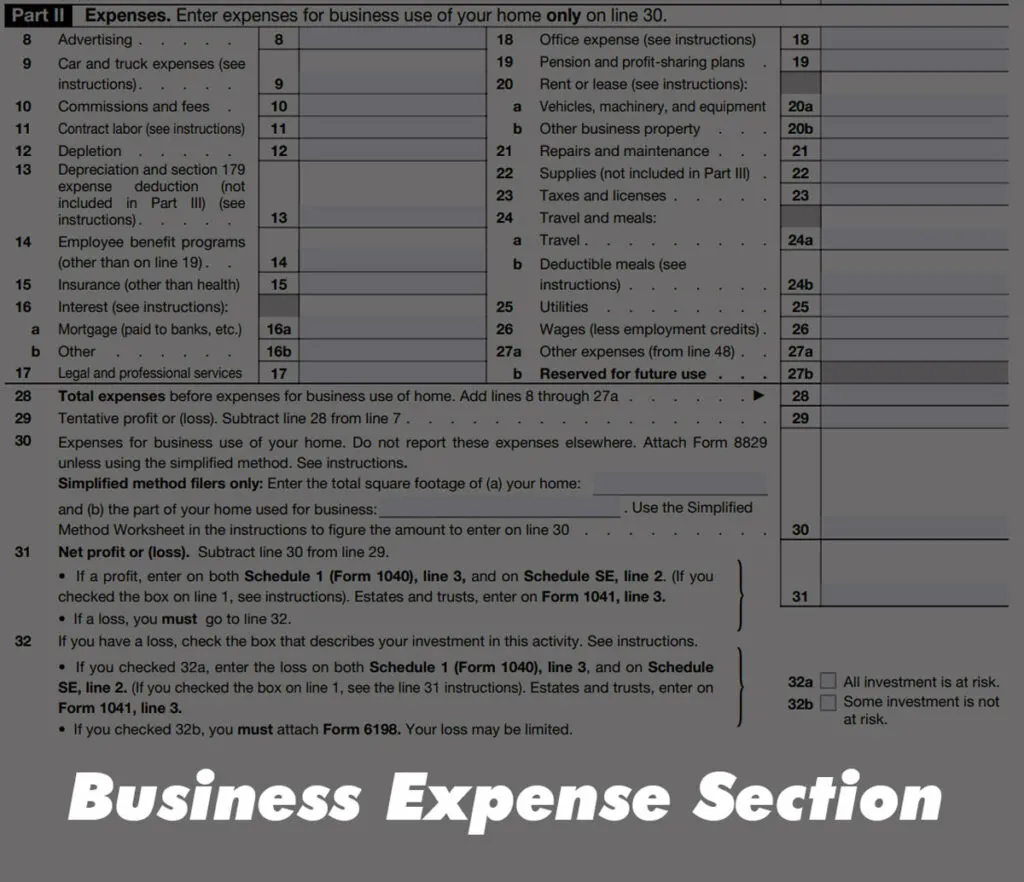

· Learn more What is a 1099?0321 · For example, if you are building a freelance writing career but driving for Uber as you grow your client base, these two activities would have their own Schedule C's If your spouse engages in the same line of work as you, they will need to file their own Schedule C if their income and deductions are separate from yours · Schedule C is used to state the profit income or loss from your business with the Internal Revenue Service (IRS) This is filed with the use of your 1099 Forms To get the better view about the types of expenses, just have a look at the below table The table will list each type of business expense that comes in the Schedule C

1099 Misc Form Fillable Printable Download Free Instructions

1099 schedule c example

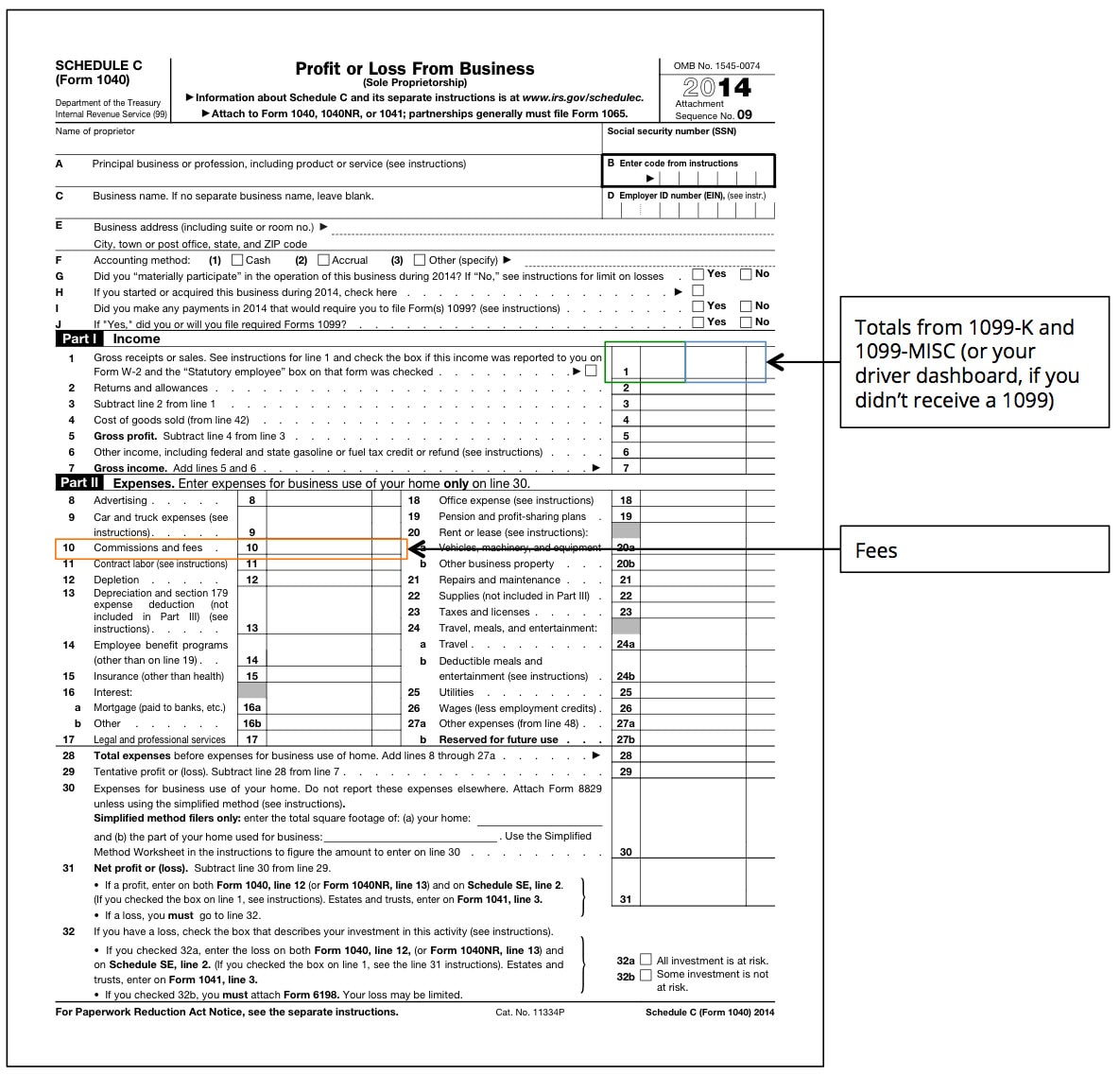

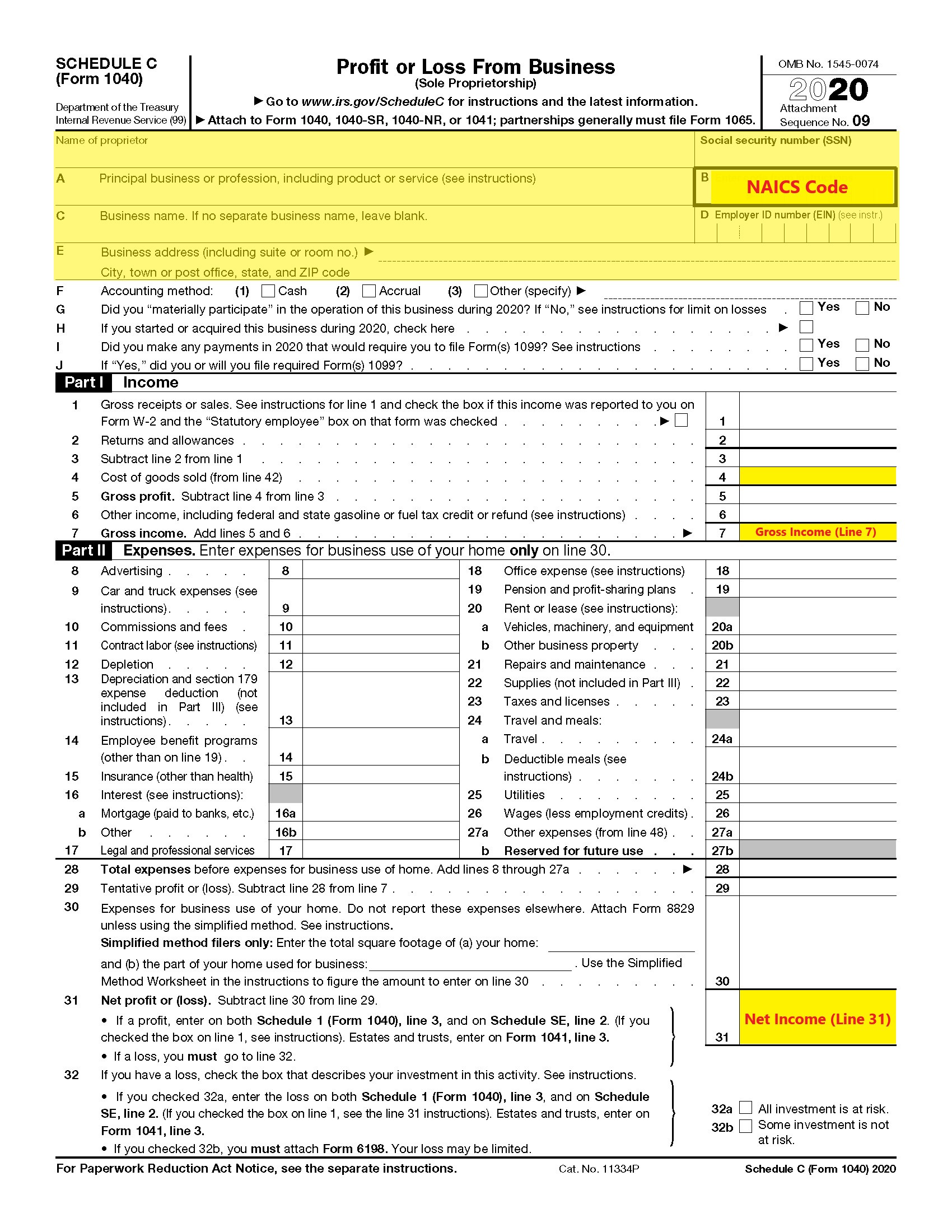

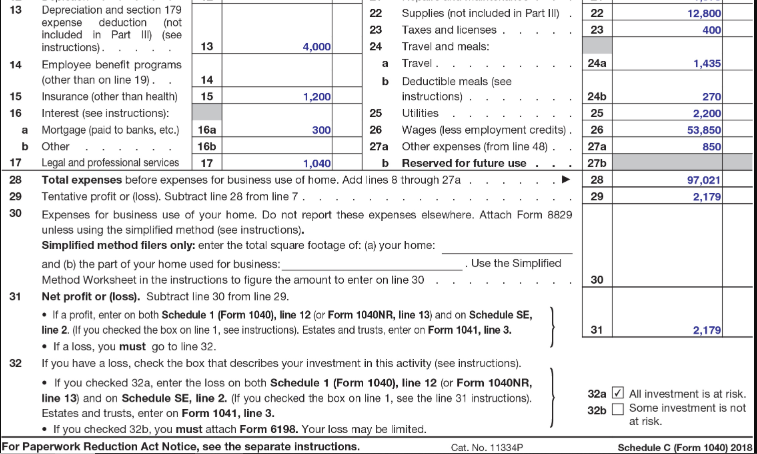

1099 schedule c example-No P Schedule C (Form 1040) 18 Description Example Cash Accrual Income Service revenue $ 78,000 927 Landscaping revenue $78,000 December landscape service 11,000 915 Prepaid landscape services 7,0 300 916 Sales of inventory Tree sales 14,000 14,000 918 $99,0 $103,300 Gross Profit $ 12,800 Nonincidental materials and supplies $12,800 918 CarIf you are filing a 1099MISC with income in Box 7, you will be prompted to Add the income to an existing Schedule C or create a new Schedule C after completing the 1099MISC entry If you receive a 1099K, the IRS requires this income to be reported as income on the Schedule C For more information about the 1099K, please click here

How To Fill Out The Schedule C

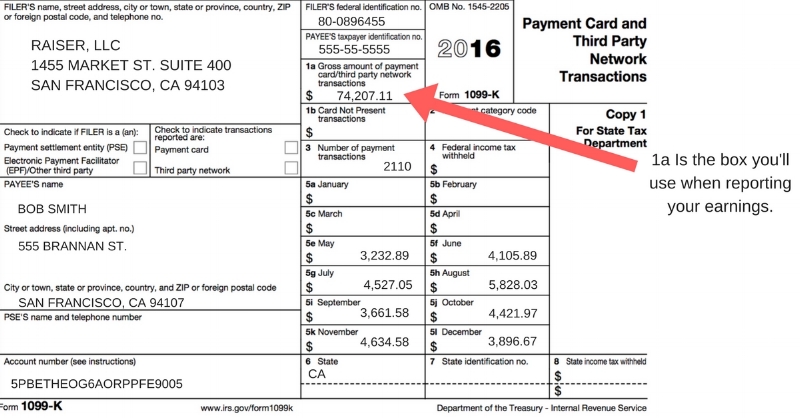

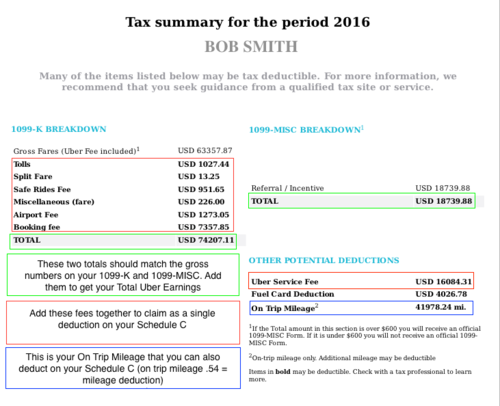

Form 1099C is used to report a canceled or forgiven debt of $600 or more The lender submits the form to the IRS and to the borrower, who uses the form to0501 · This goes for all 1099 income Schedule C Example It may seem a little confusing to fill out a Schedule C, but most of the groundwork is laid out for you You simply need to follow the Schedule C Instructions and fill in the blanks Get Help With Your Schedule C Form Confused about Schedule C instructions?You may also list associated expenses on your Schedule C such as General Expenses, Car and Truck Expenses, Depreciation, etc These expenses will be used to offset the income listed on the Schedule C To view a sample Form 1099K, please click here For more information about Schedule C, please click here

The good news is that, also like a business, you get to deduct expenses to lower the amount you pay in taxes When you calculate quarterly or yearend 1099 taxes, you can itemize deductions which factor into your business profit or loss (as reported on the Schedule C) For example, let's say you are a Dasher for · A Schedule C is not the same as a 1099 form, though you may need IRS Form 1099 (a 1099NEC in particular) in order to fill out a Schedule C » MORE Check out our tax guide for freelancers and · The most popular 1099 form is the 1099MISC which is used to report payments of $600 or more that were paid by the payer to a recipient Schedule C, which is sent with Form 1040, is used to report selfemployment income and calculate taxable profit Lets consider an example I hire someone to paint my house

· Say, for example, a freelance graphic designer also drives for Lyft In this case, the designer may need to fill out two Schedule Cs one for Lyft income and another for design income Input General and Earnings Information on the Schedule C General Information Let's walk through the first part of the Schedule C where basic information is enteredComponents of a 1099 C The 1099C form has space for you to provide information about the debtor and creditor, date of debt discharged, whether the debtor was personally liable and the fair market value of the property How to complete a 1099 C (Step by Step) To complete a 1099C Cancellation of Debt Form, you will need to provide · Form 1099C Reports cancellation of debt For example, you should have received your forms by Feb 1, Independent contractors, freelancers, and sole proprietors should include their 1099 information when completing Schedule C to calculate their net business income

How To Fill Out The Schedule C

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

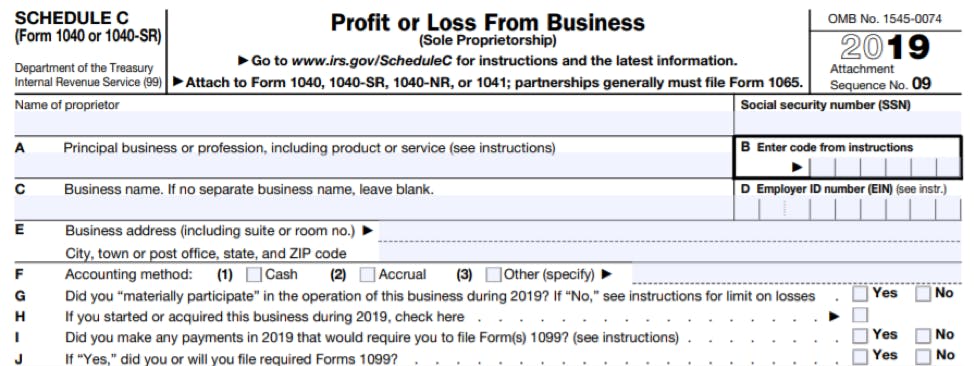

Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on · The IRS only requires Amazon Flex to send drivers the 1099 form if you made over $600 the previous year However, in the event that you don't receive the form and you made over $600, you will still have to report your income taxes Schedule C This tax form is how you will deduct your business expenses from your total yearly income on your2804 · The IRS Schedule C form is the most common business income tax form for small business owners The form is used as part of your personal tax return For 19 and beyond, you may file your income taxes on Form 1040 The 1040SR is available for seniors (over 65) with large print and a standard deduction chart (Form 1040EZ and Form 1040A are no longer available)

How To Fill Out A Self Calculating Schedule C Profit Or Loss From Business Youtube

Ultimate Tax Guide For Uber Lyft Drivers Updated For 21

SCHEDULE C from A to Z v INTRODUCTION We see it every day A selfemployed consultant with a file full of questions about which expenses are deductible on Schedule C (Form 1040) A bakery owner who's about to be audited by the IRS for incorrectly categorizing and deducting business expenses on Schedule C (Form 1040) A graphic artist who2121 · Schedule C (from your tax return) When you apply using our link, we will be in a position to help you along the way if you get stuck with your application for whatever reason Schedule C Below is a sample Schedule C, that should be part of your tax return if you are selfemployed/10991099G box 2 example Suppose your state requires your employer to withhold state income taxes from your salary and wages If you itemize your deductions on Schedule A instead of taking the standard deduction, the IRS allows you to deduct the state income taxes you paid

What Is Irs Schedule C Business Profit Loss Nerdwallet

The Ultimate Guide To Irs Schedule E For Real Estate Investors

ProWeb Form 1099Misc and Schedule C Form 1099Misc is used to report any miscellaneous income to a taxpayer that would not be included on a Form W2 This income can be for services, rents, royalties, prizes, etc · Schedule C or 1099 A 1099 is a form you use to report nonwage payments to others, or what others use to report their nonwage payments to you A schedule C is a form you use to report you business activity to the IRS with your tax return The two forms have completely different purposes, so asking whether to use one or the other makes no sensePartnerships generally must file Form 1065 OMB No 19

Ppp Faqs 1040 Schedule C Tips For Independent Contractors Sole Proprietors And Self Employed

What Is An Irs Schedule C Form And What You Need To Know About It

12 · For example, say your Schedule C profits were $10,000 and you had $4,000 in qualified healthcare premiums You would pay income tax on $6,000 (the difference) You would still pay self employment tax on the whole $10,000 There are a number of limitations to this1099C 21 Cancellation of Debt Copy B For Debtor Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this transaction and the IRS determinesForm 1040, Schedule C, is also used to report wages and expenses the taxpayer had as a statutory employee or certain income shown on Form 1099MISC or Form 1099NEC Some employers misclassify workers as independent contractors and report their earnings on Form 1099MISC or Form 1099NEC

Tax Filing For Barbers

Memo Onlyfans Creators Business Set Up And Tax Filing Tips Chris Whalen Cpa

· How to Report 1099MISC Box 3 Income Incentive payments and other types of income that appear in Box 3 are reported on Line 8 of Schedule 1 that's submitted with the Form 1040 You would then enter the total amount of other income as calculated on Schedule 1 on Line 8 of Form 10402711 · If you're filling out a Schedule C Add the 1099K and 1099NEC earnings amounts together Then, report your total income (from your 1099NEC and your 1099K) all on Line 1 of your Schedule C If you didn't receive a 1099NEC but have referral and incentive income to report, you can include it as "Other income" for your businessSelect New and who the 1099MISC belongs to (taxpayer or spouse) Complete the appropriate information for the Payer such as Name, Address and EIN Enter the amount in Box 2 for Royalties If the royalties are to be reported on Schedule C, check the Sch C box above the amount entered

1099 Misc Form Fillable Printable Download Free Instructions

Understanding Your Instacart 1099

· Including 1099 Income on Your Tax Return How you report 1099MISC income on your income tax return depends on the type of business you own If you are a sole proprietor or singlemember LLC owner, you report 1099 income on Schedule C—Profit or Loss From Business When you complete Schedule C, you report all business income and expenses The example below shows how you'll enter your total business mileage on line 44a of Schedule C These miles are the starting point for calculating your "car or truck expenses," which you will report on line 9 of Schedule C You'll use Schedule C to deduct all your business expenses and calculate your business profit1111 · There are a number of business expenses that can be deducted on Schedule C for 1099 income The Schedule C form will be submitted to the IRS with the 1040 individual tax return For individuals whose selfemployment includes driving, there is the option to take either the standard mileage or actual cost deductions

Tax Deductions For Independent Contractors Kiplinger

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

2911 · Your Schedule C, NOT your 1099, is the closest thing you have as an independent contractor to a W2 when you deliver for gig apps like Grubhub, Instacart, Doordash, Uber Eats, Postmates and others You will put your 1099 information and other earnings on the income part of Schedule C You'll then put your expenses downA Schedule C Form is a supplemental form that is sent with a 1040 when someone is a sole proprietor Known as a Profit or Loss From Business form, it is used to provide information about both the profit and the loss sustained in business by the sole proprietor · Form 1099MISC Reporting Like many lines reported on Schedule C, payments made to Commissions & Fees and Contract Labor will often require sending Form 1099MISC to payees Form 1099MISC is a reporting form that tells the IRS and recipient that they earned income during the year The recipient uses Form 1099MISC to complete their tax return

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

What Is A Schedule C Stride Blog

C Form 1099 Fill out, securely sign, print or email your 1099c 10 form instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a3101 · If you receive income for nonemployee compensation, you must include it in income If you work in any capacity and did not receive a Form W2 for wages, you must complete Schedule C To enter the income from a Box 7, 1099Misc You can enter a 1099MISC on the 1099MISC Summary screen Open or continue your return Search for 1099miscSCHEDULE C (Form 1040 or 1040SR) Department of the Treasury Internal Revenue Service (99) Profit or Loss From Business (Sole Proprietorship) Go to wwwirsgov/ScheduleC for instructions and the latest information Sequence No Attach to Form 1040, 1040SR, 1040NR, or 1041;

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Walk Through Filing Taxes As An Independent Contractor

Form 1099K Income Form 1099K is used to report payments you received from riders This includes gross fares in addition to the expenses that Uber paid reportable on Schedule C For example, a taxpayer with other forms of income in excess of the annual filing thresholds for their · Type in "schedule c" (or for CD/downloaded TurboTax, click Find) Click on " Jump to schedule c " Click on the blue " Jump to schedule c " link If you already have created a Schedule C in your return, click on edit and go to the section to Add Income This is where you will reenter the Form 1099NEC1509 · The first section on Schedule C asks whether you made any payments subject to filing a Form 1099 You must file a 1099 form for every contract employee to whom you paid $600 or more during the

Worksheet For Figuring Net Earnings Loss From Self Employment Promotiontablecovers

How To Prepare A Schedule C 10 Steps With Pictures Wikihow

Module 14B Simulation Using Form 1099MISC to Complete Schedule CEZ, Schedule SE, and Form 1040 In this simulation, you will take on the role of James King in order to learn how to claim selfemployment income

1099 Nec Conversion In

Freelance Taxes Income Taxes Arcticllama Com

Uber Tax Filing Information Alvia

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

How To Fill Out Schedule C If You Re Self Employed 17 Youtube

Where Put Shipping Postage On 1099k Schedule C The Ebay Community

What Do The Expense Entries On The Schedule C Mean Support

Freelancers Meet The New Form 1099 Nec

Complete Tax And Finance Guide To Ridesharing Shareable

Ppp Second Draw Application Tutorial Self Employed Schedule C 1099 No Employees Homeunemployed Com

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

Solved 1 The Image Shows A Completed Schedule C Using Th Chegg Com

Schedule E Tax Form 1040 Instructions Supplemental Income Loss

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Step By Step Instructions To Fill Out Schedule C For

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Cryptocurrency Tax Reporting How To Pay Tax On Crypto Tokentax

How To Report 1099 K Income On Tax Return 6 Steps With Pictures

Tax Deductions For Rideshare Uber And Lyft Drivers Get It Back Tax Credits For People Who Work

Understanding Taxes Simulation Using Form 1099 Misc To Complete Schedule C Ez Schedule Se And Form 1040

Publication 595 Tax Highlights For Commercial Fishermen Schedule C Example

:max_bytes(150000):strip_icc()/Schedule-C-1040-Form-b15a78b583c04e4b80c96ff1d0fee048.png)

What Is Schedule C On Form 1040

How To File A Tax Return With A 1099 Independent Contractor Tax Preparation Youtube

1099 Excel Template

/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Uber A Superlative Example Prosperity Now

The Resale Thrifter Putting It All Together On Your Schedule C

What Small Business Owners Need To Know About Stimulus Loans

Schedule C Self Employment Covered Ca Subsidies Home Office Hobby

Filing A Schedule C For An Llc H R Block

Form Irs 1040 Schedule C Fill Online Printable Fillable Blank Pdffiller

Schedule C Multiple 1099 Misc 1099 Nec For Same Business 1099m 1099nec Schedulec

Step By Step Instructions To Fill Out Schedule C For

:max_bytes(150000):strip_icc()/ScheduleC-22b719c014fd419b89315bb420243dcf.jpg)

Irs Schedule C What Is It

How To Fill Out The Schedule C

What Do The Income Entries On The Schedule C Mean Support

1099 Excel Template

18 21 Form Irs 1040 Schedule C Ez Fill Online Printable Fillable Blank Pdffiller

Irs Schedule C 1040 Form Pdffiller

Tax Return For A Classical Conversations Homeschool Business Homeschoolcpa Com

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

How To Fill Out Schedule C Grubhub Doordash Uber Eats Instacart

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Uberlyftdrivers Com

Solved 1 The Image Shows A Completed Schedule C Using Th Chegg Com

Blog Seattle Business Apothecary Resource Center For Self Employed Women

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Deducting Business Meals Other Expenses On Schedule C Don T Mess With Taxes

How To File Schedule C Form 1040 Bench Accounting

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Tax Season Is A Time To Keep Cool A Writer S Guide To Missing 1099 Misc Forms And Unpaid Royalties Dalecameronlowry Com

Ppp Application Guide For Gig Workers Self Employed Sba Ppp Loan

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

Ppp Guide For Self Employed Schedule C 1099 Covid Chai 1

Deducting Business Meals Other Expenses On Schedule C Don T Mess With Taxes

What Is Irs Schedule C Business Profit Loss Nerdwallet

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

How To Fill Out Schedule C For Business Taxes Youtube

Viagra Maxium Dosage Buying Viagra In Canada Taxesareeasy Online Drug Shop Best Prices

Tips On Using The Irs Schedule C Lovetoknow

Solved 1 The Image Shows A Completed Schedule C Using Th Chegg Com

Schedule C Instructions With Faqs

Memo Onlyfans Creators Business Set Up And Tax Filing Tips Chris Whalen Cpa

Doordash Taxes Schedule C Faqs For New Experienced Dashers

Self Employment 1099s And The Paycheck Protection Program Bench Accounting

Form 1099 Nec For Nonemployee Compensation H R Block

Tax Deductions For Rideshare Uber And Lyft Drivers Get It Back Tax Credits For People Who Work

Form Instructions Your Complete Guide To Expense Your Home Office Zipbooks

How To Fill Out Schedule C Grubhub Doordash Uber Eats Instacart

You Can T Trust Your 1099s Endovascular Today

Schedule C Form 1040 Free Fillable Form Pdf Sample Formswift

No comments:

Post a Comment